Published May 2025 | Putterills Estate Agents

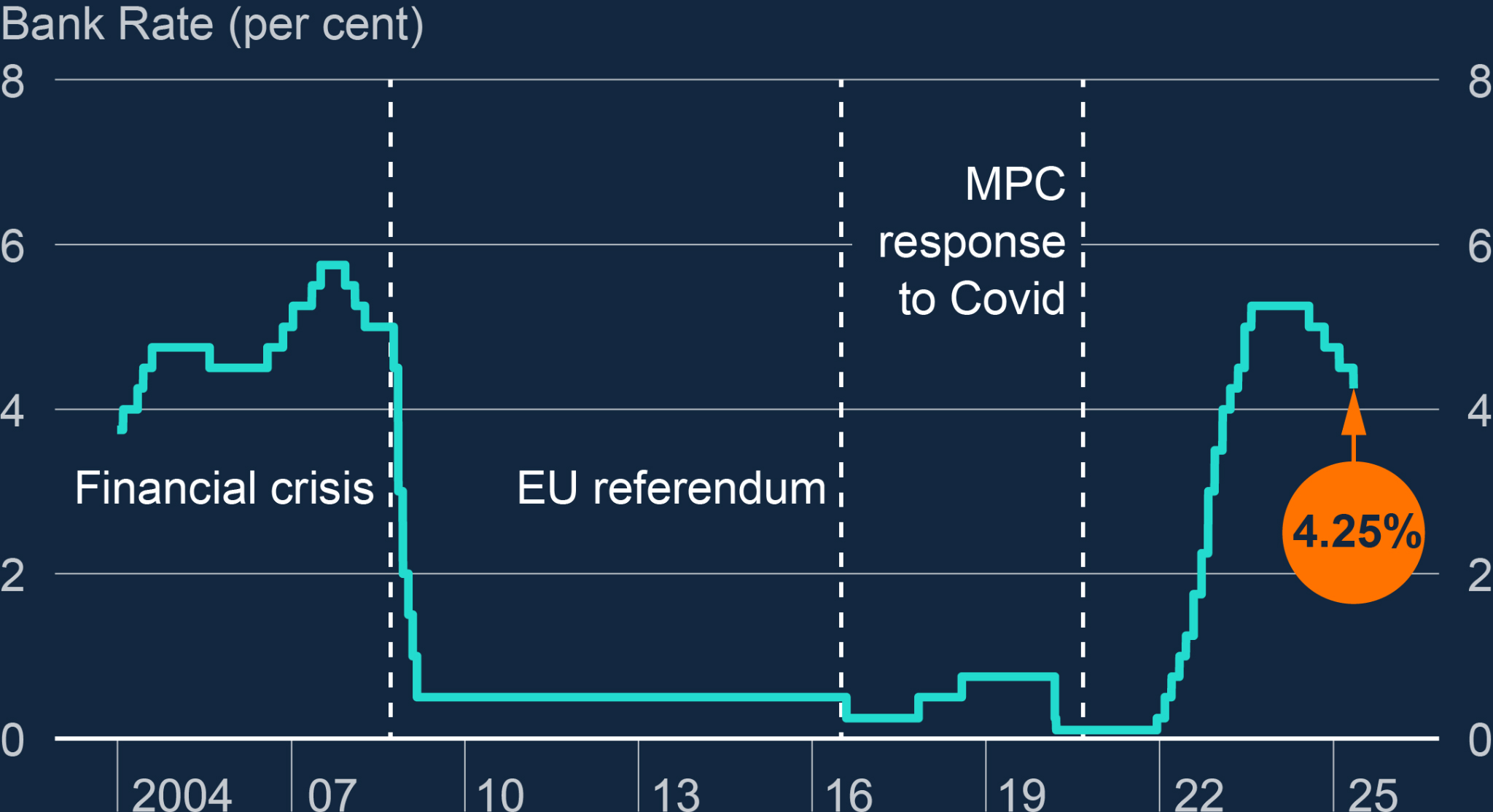

The Bank of England has reduced the base rate to 4.25%, the fourth cut in a year and the lowest level since May 2023. This marks the fastest sequence of reductions since the financial crisis of 2008–09 and reflects a continued effort by the Monetary Policy Committee (MPC) to stabilise the UK economy amid moderating inflation and broader global uncertainty.

But what does this mean for buyers, sellers, and landlords across Hertfordshire?

The Rationale Behind the Cut

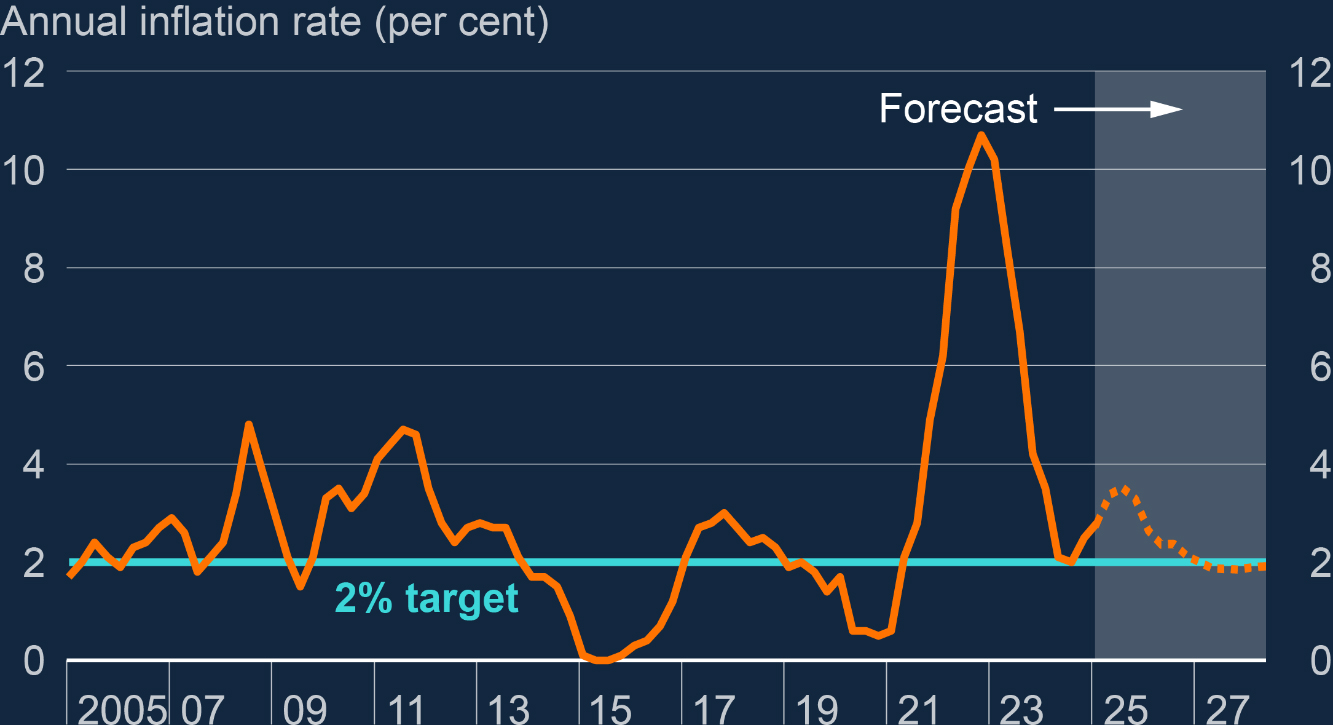

The MPC’s decision followed the latest data showing UK inflation at 2.6% in March—below expectations and a marked decrease from its 2022 peak of over 11%. While the Bank expects inflation to briefly rise again to 3.7% later this year due to higher energy prices, it forecasts a return to the 2% target thereafter.

Five committee members voted to reduce the rate, with two preferring a steeper cut to 4%, and two voting to hold it steady at 4.5%. The split reflects uncertainty within the Bank itself over the future path of interest rates.

Governor Andrew Bailey stated that further rate cuts are likely, though cautioned that monetary policy will remain responsive to economic developments both in the UK and globally.

Mortgage Implications for Hertfordshire Homeowners

Roughly 600,000 UK homeowners on tracker mortgages will see immediate benefit, with typical monthly repayments falling by around £29. Those on standard variable rates may also see reductions, depending on their lender’s response.

For most homeowners with fixed-rate mortgages, the real impact will be felt when their current deals expire. Encouragingly, average fixed rates have continued to fall:

• The average two-year fixed rate is now 4.64% (down 0.77% from a year ago)

• The five-year average sits at 4.60% (down 0.41%)

Major lenders including Barclays, HSBC, NatWest, Halifax, Nationwide, and Santander have already introduced sub-4% fixed-rate mortgage products, signalling improved affordability.

Confidence and Demand in the Local Market

In Hertfordshire, we are already seeing encouraging signs of increased activity. Since the first interest rate cuts last August, market confidence has improved, resulting in:

• Higher levels of buyer enquiries and viewings

• Increased numbers of properties coming to market

• A rise in mortgage approvals and agreed sales

In April, consumer confidence in the UK housing market rose to 29%, with more renters now believing that home ownership is achievable within the next five years. This is up from just 15% the previous month.

Additionally, there has been an uplift in renters saving for deposits, supported by the availability of more low-deposit mortgage products. According to Moneyfacts, the number of 5% and 10% deposit mortgages is now at its highest level since 2008.

What This Means for Sellers

For homeowners in Hertfordshire considering selling, this environment presents a strong opportunity. Buyers are better positioned financially and more confident about their prospects. Nearly one in four mortgage holders are actively overpaying, aiming to reduce their mortgage term by an average of four years—indicating long-term commitment and financial prudence.

Lower interest rates tend to result in more active markets rather than rapid price growth. However, they do help improve transaction volumes and reduce time on market—particularly beneficial after recent stamp duty changes and the challenges of 2023.

Future Outlook for Interest Rates and Lending

While financial markets anticipate further reductions—potentially down to 3.75% by the end of 2025—public sentiment remains divided.

A recent survey by the HomeOwners Alliance found that:

• 37% of adults expect mortgage rates to rise

• 16% believe they will fall

• 25% think rates will remain stable

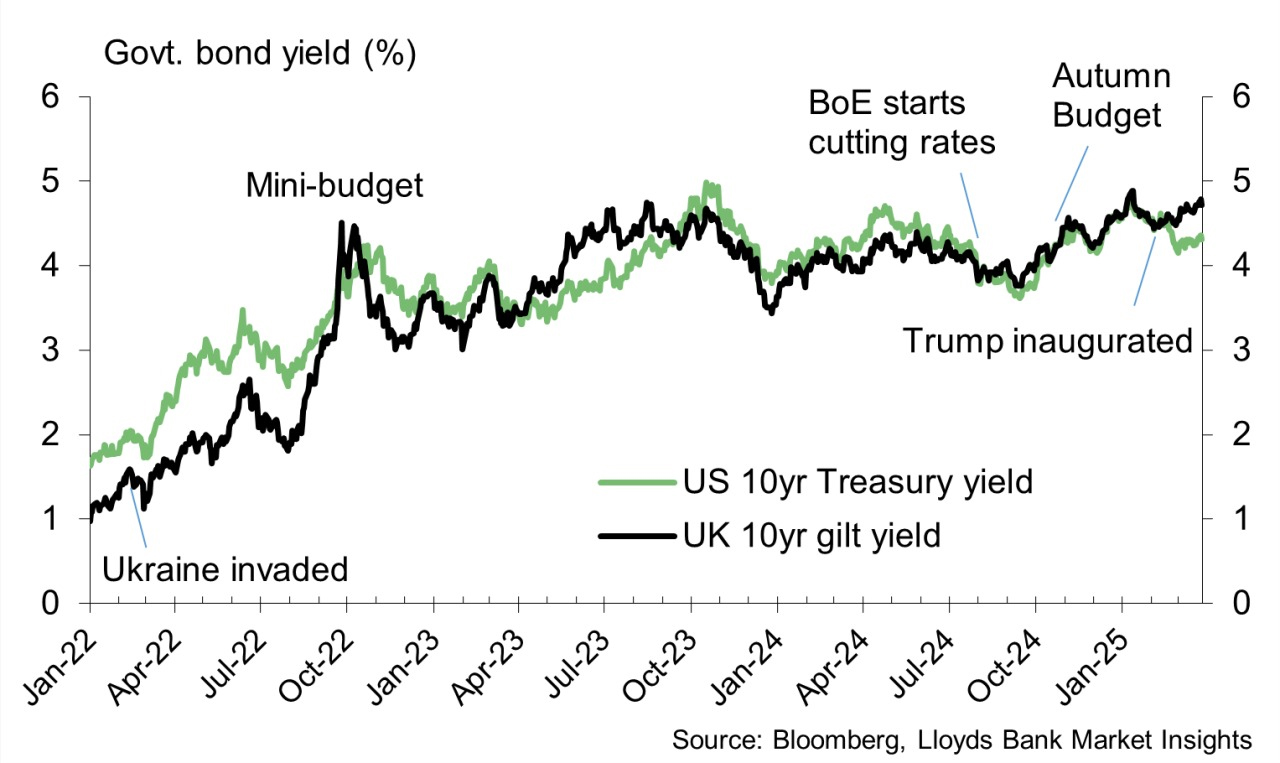

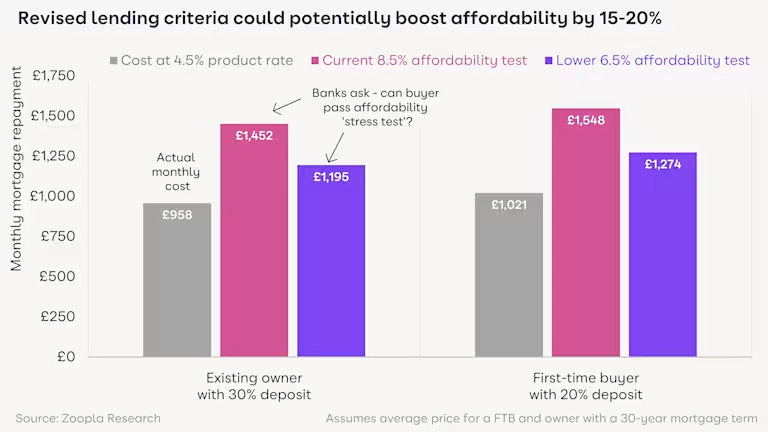

The actual interest rate paid on new mortgages (the ‘effective rate’) stood at 4.53% in February. However, as swap rates and gilt yields continue to ease, lenders have greater flexibility in pricing. Importantly, there is growing support for reducing the affordability stress testing criteria, which would significantly increase buyers’ purchasing power without artificially inflating prices.

Implications for the Hertfordshire Market

At Putterills, we anticipate a more buoyant market across our offices in Hitchin, Welwyn Garden City , Knebworth , Stevenage and surrounding areas throughout the second half of 2025. The base rate cut offers tangible benefits to both buyers and sellers:

• Increased affordability for purchasers

• Renewed energy in market activity

• More choice and flexibility in mortgage products

• Greater movement across all tiers of the housing ladder

In particular, we expect to see greater engagement from first-time buyers and second-steppers, especially those making use of lower deposit products and improved lending criteria.

Conclusion

The Bank of England’s decision to reduce the base rate to 4.25% is a proactive and encouraging step. It reflects confidence in the current inflation trajectory and a commitment to stimulating broader market activity without triggering instability.

For those considering buying or selling in Hertfordshire, the current environment offers improved affordability, better mortgage options, and increasing levels of buyer demand.

If you’re planning your next move or reviewing your property’s potential value, now is an ideal time to speak to our team.

For expert advice tailored to your circumstances, contact your local Putterills branch today.

⸻