Is Hertfordshire the New Goldilocks Zone?

Why the Autumn Budget Has Tilted the Scales in Favour of the Home Counties

If behavioural economics teaches us anything, it’s that people rarely move purely because of numbers.

They move because something feels wrong… and something else feels just right.

And right now, Hertfordshire sits squarely in that Goldilocks zone, neither too pricey nor too remote, neither too urban nor too suburban, offering precisely the blend of value and lifestyle that London has quietly priced itself out of.

The Autumn Budget didn’t create this shift, but it may have accelerated it. In fact, the measures announced by the Chancellor have made Hertfordshire more attractive to three groups simultaneously:

sellers, buyers, and landlords/investors.

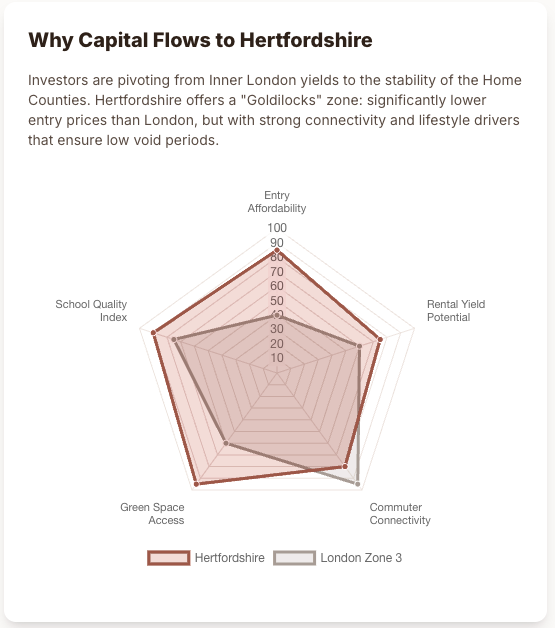

The chart above tells the behavioural story perfectly:

• Better entry affordability than London

• Stronger rental yields

• Outstanding school quality

• More green space

• Fast commuter connectivity

If you designed a region for post-pandemic, hybrid-working, tax-sensitive Britain, you’d design Hertfordshire.

But the Autumn Budget has added a new layer it has widened the gap between how it feels to live in London and how it feels to live here.

London absorbs the tax pain; Hertfordshire absorbs the demand.

This is where the “Goldilocks” analogy becomes powerful:

Hertfordshire is not a tax haven, nor a bargain basement. It’s the rational midpoint.

The place where Londoners go when they want quality of life without financial self-flagellation.

The Autumn Budget: What Actually Changed and Why Herts Benefits

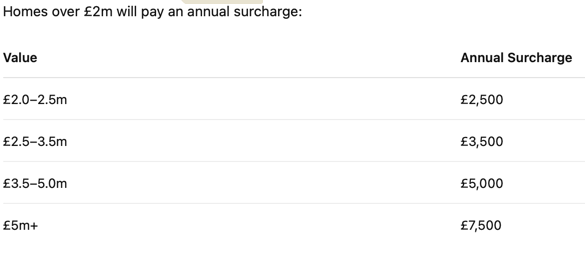

1. The Mansion Tax (April 2028): London Takes the Hit, Hertfordshire Takes the Demand

This affects less than 0.5% of all UK sales, but it hits London disproportionately hard.

What this means for Hertfordshire

More London vendors will consider moving north, especially those fed up with running costs on modest London terraces in the £2m–£3m range. A buyer spending £2.5m in Tewin or Hitchin can get a substantial detached family home, not a townhouse squeezed between two others. This trend is already happening and will intensify as 2028 approaches.

A £2m psychological ceiling emerges in Herts Properties valued at £2.1m–£2.3m will encounter price resistance, expect strategic pricing between £1.95m and £1.99m to become typical.

Prime Herts remains aspirational, but now also financially sensible. London’s struggles are Hertfordshire’s attraction. The Budget has only heightened the contrast.

Stamp Duty: No Changes and That’s Actually Good News

The Chancellor changed nothing.

No new surcharges, no reliefs, no deadlines.

And for once, stability is a gift.

It means Hertfordshire buyers and sellers can plan without wondering whether waiting three months will save (or cost) thousands.

In a market that’s been interrupted repeatedly since 2020, that stability is enormously valuable.

So… How Does All This Affect Hertfordshire Clients?

For Sellers (Vendors)

Hertfordshire is gaining more buyers from London

Hybrid working is now standard and higher taxes on London property make Hertfordshire even more appealing.

Sub-£2m homes will remain incredibly strong

These are precisely the homes London families want and can afford.

Prime £2m+ homes need strategic pricing

We’re entering a world where £2m is a visible psychological threshold.

The opportunity:

If you’re considering selling in the next 12–36 months, this is an ideal time to understand how the Budget reshapes demand for your property.

For Buyers

You’re shopping in a county that is outperforming surrounding areas

Demand is structural, not temporary.

No SDLT surprises mean you can plan your move sensibly

What you see today is what you get.

Long-term fundamentals are exceptionally strong

Schools, green space, connectivity, and stable demand support values.

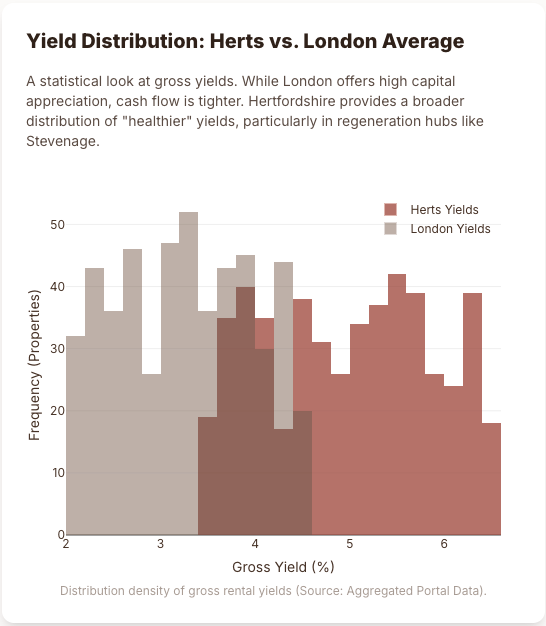

For Landlords & Investors

Expect higher rents and tighter supply.

Tenant competition in Welwyn Garden City, Knebworth, Hitchin, Welwyn and Stevenage will remain intense.

Review your tax structure well before 2027

Limited companies become increasingly attractive as personal tax rises.

EPC compliance remains a key driver of yield

Turnkey EPC-C properties are attracting a premium – both in sales and rents.

Hertfordshire’s Goldilocks Moment

If you strip away the economics, the charts, the political language and the spreadsheets, the Budget reveals a surprisingly simple truth:

London is slowly becoming too expensive to own in.

Outer regions are too far or too disconnected.

Hertfordshire sits perfectly in the middle.

Not too costly.

Not too far.

Not too compromised.

Just right.

This is why capital is flowing here.

Why families are moving here.

Why investors are repositioning here.

And why sellers are achieving strong results when they price intelligently.