North Hertfordshire Housing Market Report November 2025

This report combines the latest national housing market trends with specific local data for Hertfordshire. Our focus is to provide clear, actionable insights for you, our clients, whether you are considering selling or buying in the current market.

The National Picture: A Market Catching Its Breath

Across the country, the housing market is taking a pause.

Rightmove’s latest figures show asking prices rising by just +0.3% this October far below the usual autumn lift of around 1.1%. It’s a clear sign that buyers are firmly back in control, with a “decade-high level of choice” giving them more room to negotiate.

That said, activity hasn’t disappeared. Sales agreed are 5% higher than this time last year, showing that while buyers are more cautious, they’re still active — just more selective and price-aware, especially with the Autumn Budget approaching.

Local Insight: What’s Really Happening in North East Hertfordshire

When we focus on our own area, the data paints a more detailed picture of how this balance between buyers and sellers plays out locally.

• The average asking price for homes currently available in North East Hertfordshire is £427,730, which equates to about £452 per square foot.

• Over the past 12 months, homes have actually sold for an average of £393,837, or around £433 per square foot.

• In short, most properties are selling slightly below their initial asking prices — a reflection of today’s more realistic, data-driven market.

• Around one in three homes (33.9%) on the market has seen a price reduction since first being listed, as sellers adjust to meet current demand.

• For context, Rightmove’s national figure for the same period is £420,254, showing our area continues to hold its premium positioning, even within a cooling national backdrop.

Hertfordshire Overview: A Premium County in a Calmer Phase

Hertfordshire remains one of England and Wales’s most desirable and valuable counties.

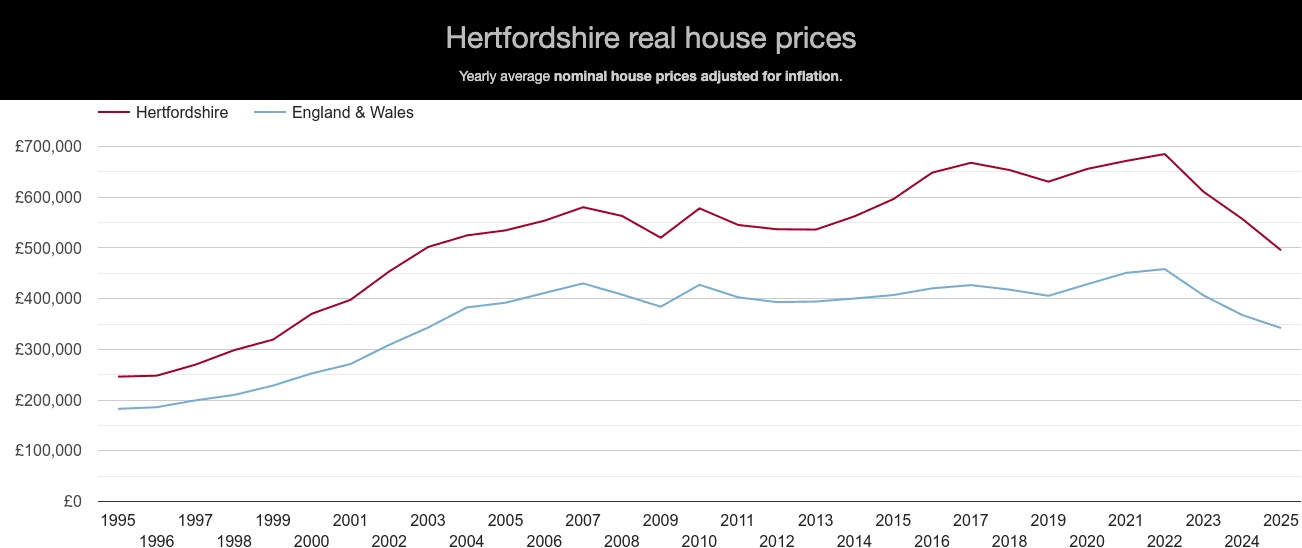

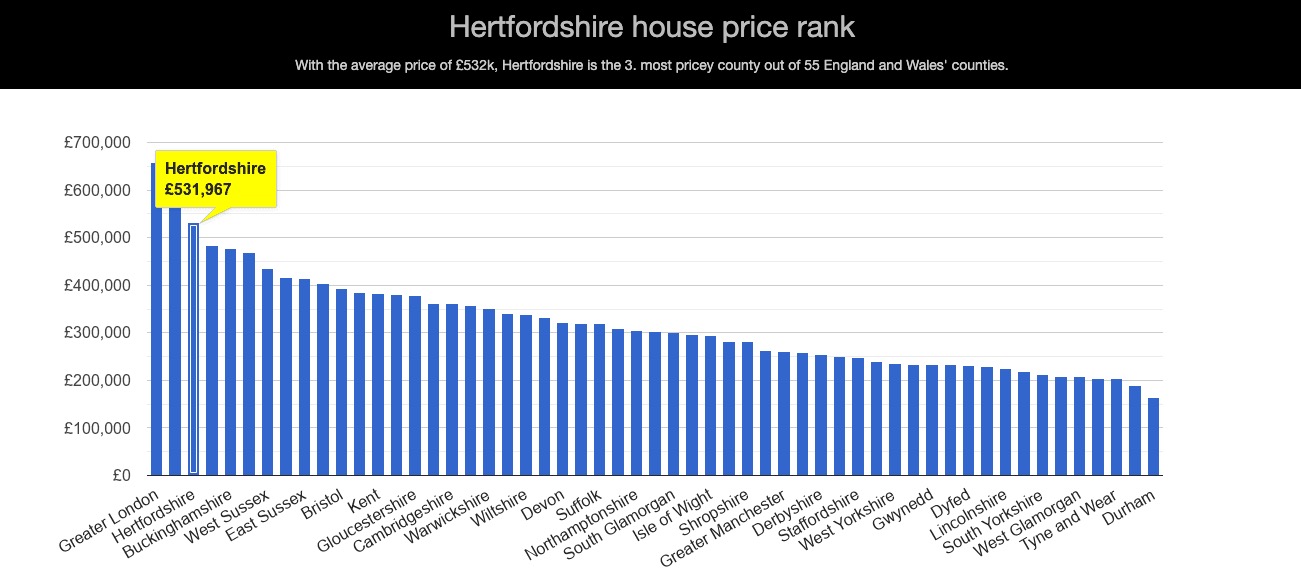

It currently ranks as the third most expensive, with average sale prices comfortably above national levels but price growth has now flattened.

Over the past year, sold prices have seen virtually no overall change, and when adjusted for inflation, values are slightly lower than their 2022 highs. Homes here still command impressive prices, but the market is now more balanced.

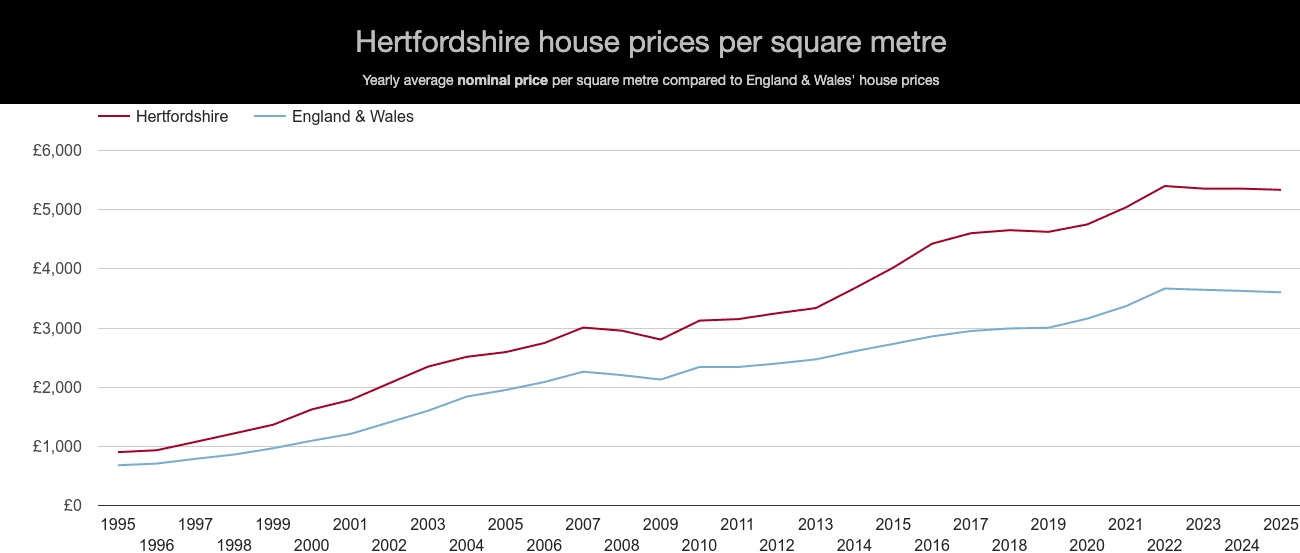

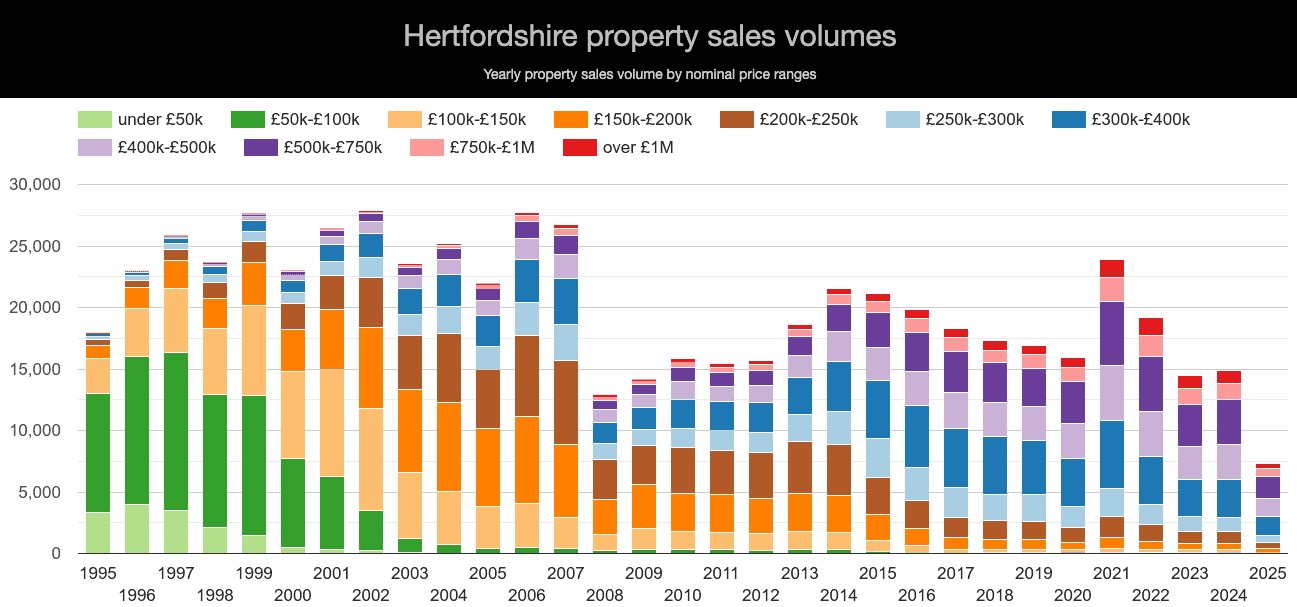

The average price per square foot in Hertfordshire stands at around £492, compared to a national average of roughly £340. This premium reflects both the area’s quality of life and its proximity to London, even as values stabilise. Sales activity has softened in the £750,000+ range, with most movement now happening between £400,000 and £750,000 still an active middle market, but more measured than before.

What This Means for Putterills Sellers

With buyers facing more choice and greater confidence, successful selling today is about standing out for the right reasons. The key lies in realistic pricing and strategic marketing.

1. Focus on the Facts

Forget national averages — they don’t reflect your home’s true worth.

Instead, base expectations on recent local sold prices and price per square foot evidence. This ensures your property is positioned where real buyers are engaging.

2. Price to Attract, Not Just to Impress

In a buyer’s market, your launch price sets the tone.

At Putterills, we use genuine sold data to agree a Marketing Price designed to place your home attractively within Rightmove’s key search bands — maximising initial visibility and interest.

3. Be Proactive, Not Passive

Today’s market rewards energy and focus. Our five-step sales process is built for results:

• Strategic Marketing Price to generate immediate attention.

• Impactful Launch that consolidates viewings to build momentum.

• Best and Final Offers to create a clear deadline and competition.

• Regular Marketing Reviews to adapt based on results.

• Strong Sale Progression to secure completion and reduce fall-through risk.

4. Understand Your Segment

• High-end homes (£900k+) are most affected by Budget speculation realistic pricing is essential.

• Mid-market properties (£400k–£600k) remain active but competitive. National data shows asking prices here are gently easing, meaning sharper pricing can give you the edge.

What This Means for Putterills Buyers

If you’re buying this autumn, the balance of power is firmly in your favour.

1. More Choice Than in Years

With a record number of homes available, buyers have more opportunity.

2. A Window of Affordability

Prices are stable, and mortgage rates remain lower than a year ago. This creates a favourable, though potentially temporary, buying window before rates or policies shift again.

3. Understanding the New Stamp Duty Rules

Since April 2025, Stamp Duty Land Tax (SDLT) thresholds have changed slightly:

• First-time buyers pay no SDLT up to £300,000, then 5% above that.

Example: A £336,000 purchase would attract around £6,800 in SDLT.

• Home movers pay no tax up to £125,000, then 2% up to £250,000, adding about £2,500 compared to pre-April rates for homes above £250k.

4. Negotiating Power

With sellers adjusting to a more balanced market and around a third already reducing prices, well-prepared buyers are in a strong position to negotiate, particularly in the £600k+ range where caution is greatest.

In Summary

The North Hertfordshire market in October 2025 is steady, thoughtful, and opportunity-rich.

Prices remain high by national standards, but growth has levelled. Buyers benefit from greater choice and leverage, while sellers must now focus on evidence-led pricing and professional presentation.

At Putterills, our role is to interpret these trends for you, turning data into strategy and market shifts into results.

Whether you’re planning to sell, buy, or simply understand your home’s current value, our team is here to guide you through every step with clarity and confidence.