Hertfordshire Property Market Outlook 2025: A Comprehensive Analysis

As we approach 2025, the Hertfordshire property market shows resilience and promising signs of growth. At Putterills, we’ve combined our local insights with national trends to provide you with a detailed outlook for the coming year.

Recent Market Performance

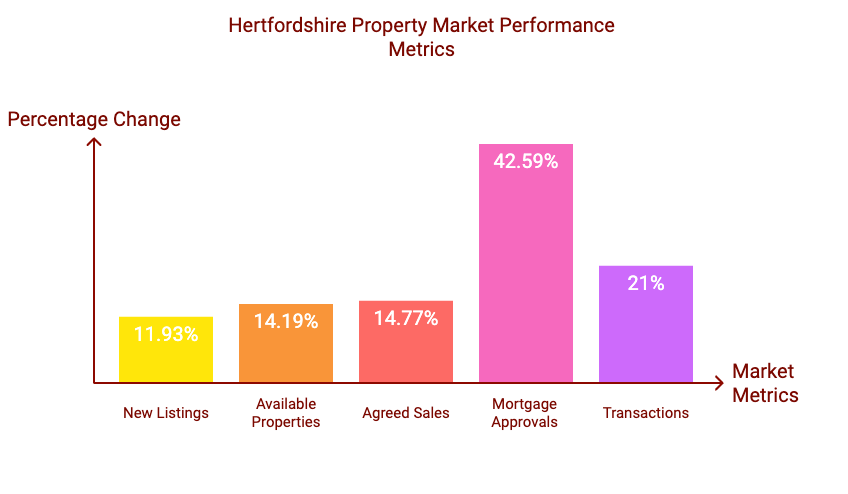

November 2024 demonstrated robust activity in the Hertfordshire market:

• New listings increased by 11.93% year-on-year and were 20.09% higher than the six-year average.

• Available properties rose by 14.19% compared to last year and were 34.76% above the six-year average.

• Agreed sales saw a 14.77% increase year-on-year and a 15.81% rise compared to the six-year average.

These figures indicate that the recent election and economic changes have not dampened activity, particularly in the premium sector.

We’ve observed:

• An increase in sellers returning to the market who had previously attempted to sell.

• A significant rise in price adjustments, likely due to stronger market conditions and increased competition.

Mortgage and Transaction Activity

The broader UK property market, influencing Hertfordshire, showed positive signs:

• Mortgage approvals increased by 42.59% year-on-year, reaching their highest level since August 2022.

• Transactions were up 21% compared to last year, 10% higher than the previous month, and 3.25% above the 10-year average.

• For the first time since August 2022, monthly transactions exceeded 100,000.

However, we’ve observed a rise in properties being withdrawn from the market across Hertfordshire, possibly indicating some caution among buyers or that the initial advice on pricing was incorrect by some agents eager to secure instructions without a clear and accountable strategy.

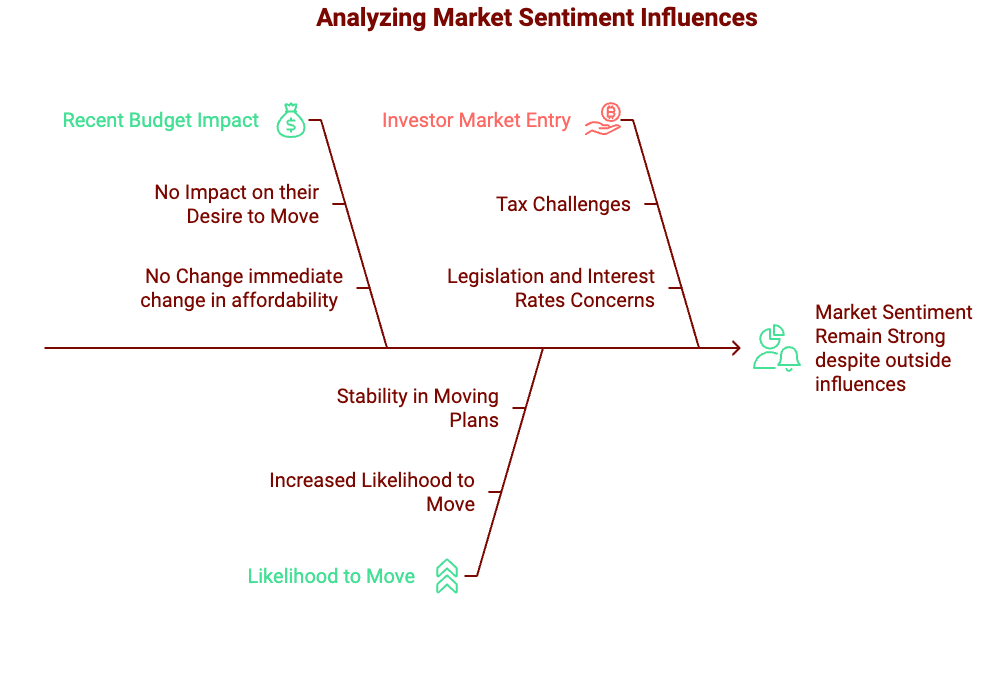

Market Sentiment

A survey of nearly 1,000 clients in November revealed:

• 54% said the budget would have no impact on their desire to move or their budget.

• 28% reported being more likely to move.

• Investors were less likely to enter the market due to continued challenges with tax, legislation, and interest rates.

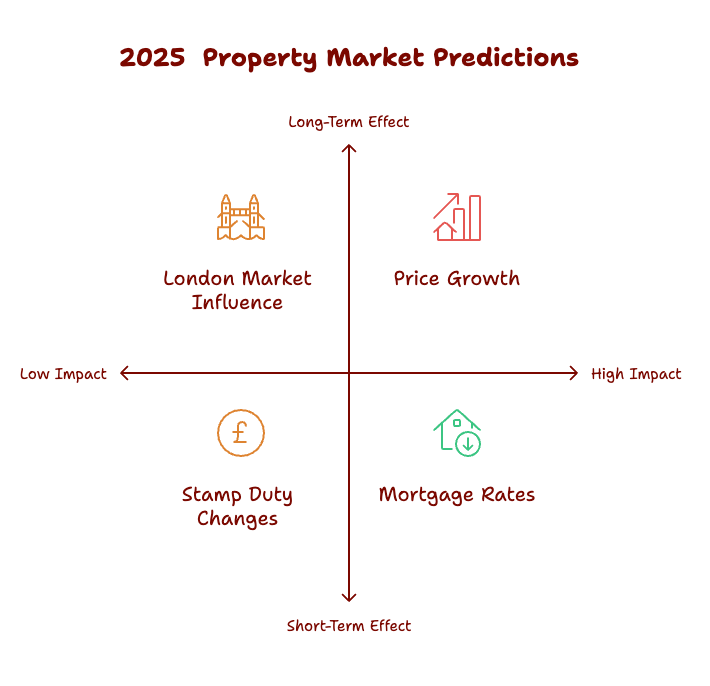

2025 Market Predictions

1. Continued Buyer’s Market:

• Improved choice of homes for sale

• Longer average time to sell

• Buyers having more negotiating power

2. Price Growth:

• Predicted 4% increase in average asking prices by the end of 2025

3. Mortgage Rates:

• Five-year and two-year fixed rates could drop to around 4.0%

• Potential for four Bank of England Base Rate cuts, possibly bringing it down to 3.75%

4. Transaction Volume:

• Prediction of 1.15 million transactions in 2025, approaching the 1.2 million 50-year average

5. Stamp Duty Changes:

• New rates from April 1, 2025, may cause a rush of activity in Q1

• First-time buyer enquiries already up 13% compared to last year

6. Remortgaging Focus:

• Crucial year for homeowners coming off fixed-rate deals

• Potential for lower monthly repayments for those remortgaging from higher rates

7. London Market Influence:

• Expected resurgence in London could have spillover effects on Hertfordshire

Seasonal Market Trends

• Boxing Day typically sees increased property portal activity, but often for price reductions rather than new listings.

• January, February, and March are historically the busiest months for property searches and sales.

• We advise sellers to consider a “soft launch” before the New Year, with full portal listings in early 2025.

What This Means for Hertfordshire Residents in 2025

For Buyers:

• More choice and negotiating power

• Potentially more affordable mortgages

• Opportunity to enter the market before potential price increases

For Sellers:

• Need to price competitively

• Consider timing your listing for early 2025

• Importance of making your property stand out in a buyer’s market

For Homeowners:

• Good time to review your mortgage, especially if your fixed term is ending

• Potential to benefit from lower remortgage rates

Conclusion

Despite the ongoing economic challenges, dubbed “Permacrisis” by some, the Hertfordshire property market has shown remarkable resilience. The “just get on with it” attitude among home movers, coupled with improving market conditions, suggests a positive outlook for 2025. With stock levels at a 10-year high and interest rates steadily decreasing, we anticipate a dynamic and opportunity-rich market in the coming year.

At Putterills, we’re here to guide you through these market conditions, providing expert advice tailored to your specific situation in the Hertfordshire property market. Whether you’re looking to buy, sell, or simply understand your options, our team is ready to assist you in making the most of the opportunities that 2025 presents in Hertfordshire’s unique property landscape.