Hertfordshire ( Landlord) Rental Market Update

Market Update and review of 2024

The rental market in NE Hertfordshire demonstrated remarkable resilience throughout 2024, with several positive indicators setting it apart from national trends.

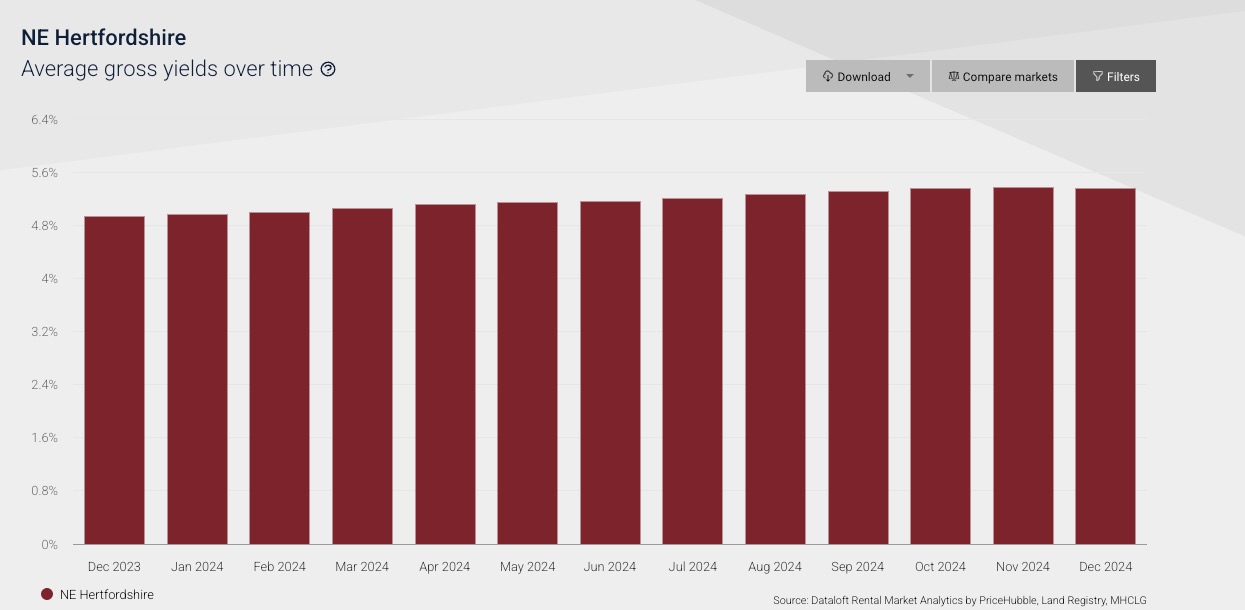

Supply of rental properties showed consistent growth, reaching peak levels in late 2024, with approximately 700 properties available to rent. This increase in supply has been accompanied by strong rental yields, maintaining a stable 4.8% throughout the year.

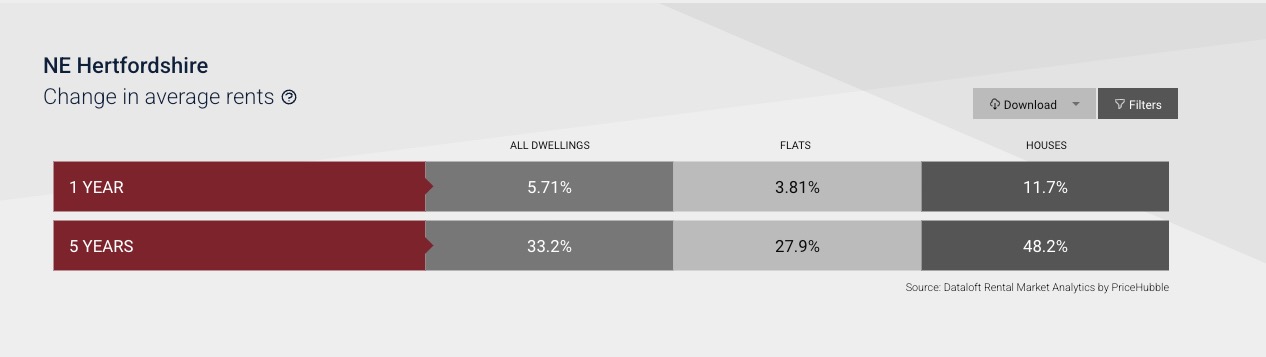

Rental Growth Performance

The region has experienced impressive rental value appreciation:

• Houses have seen an 11.7% increase over one year in rental premiums

• Overall market growth of 5.71% across all property types

• Five-year growth detailing rental premiums charged have risen by 48.2% for houses and 33.2% for all dwellings

Average gross yields over time

Even with more rental properties coming to market locally , landlords still achieve healthy returns—an indication of sustained tenant demand and rental growth in the local Hertfordshire area

Property Type Premiums

Current average rents by property type show clear market segmentation in NE Hertfordshire. Detached properties top the scale at over £2,100 per month on average, reflecting their desirability and scarcity.

• Detached properties: £2,100 pcm

• Semi-detached: £1,600 pcm

• Terraced: £1,400 pcm

• Flats: £1,000 pcm

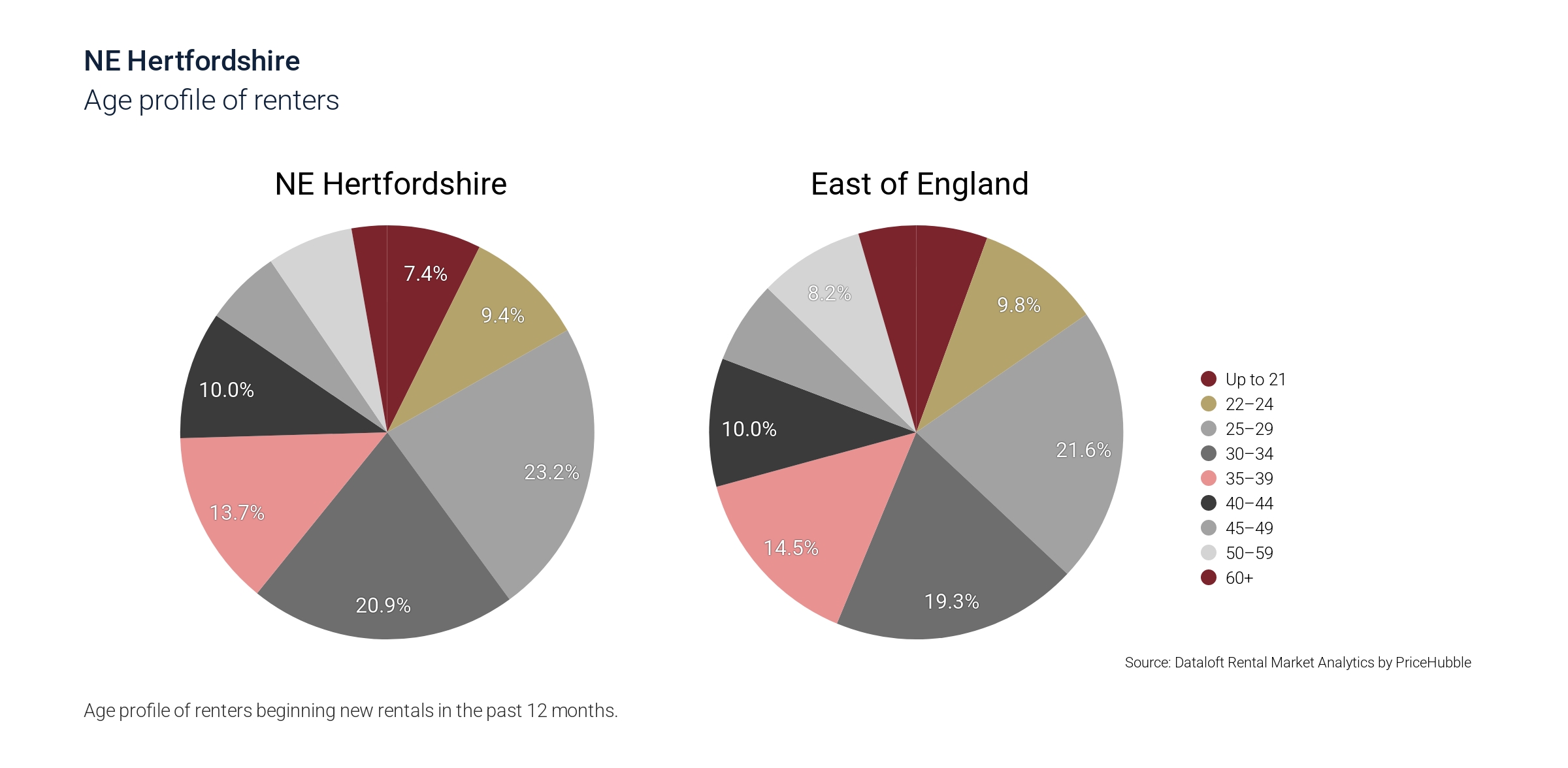

Age profile of renters

A comparison of age groups starting new tenancies over the past 12 months, for NE Hertfordshire and the East of England as a whole.

With people aged 30–39 age bracket most dominant tenants in NE Hertfordshire, a particularly large share of new renters fall into their early to late 30s—a prime working‐age demographic seeking flexibility.

There is a growing number of older tenants (50+) demonstrating that rental housing is accommodating a full spectrum of life stages, from early‐career professionals to retirees.

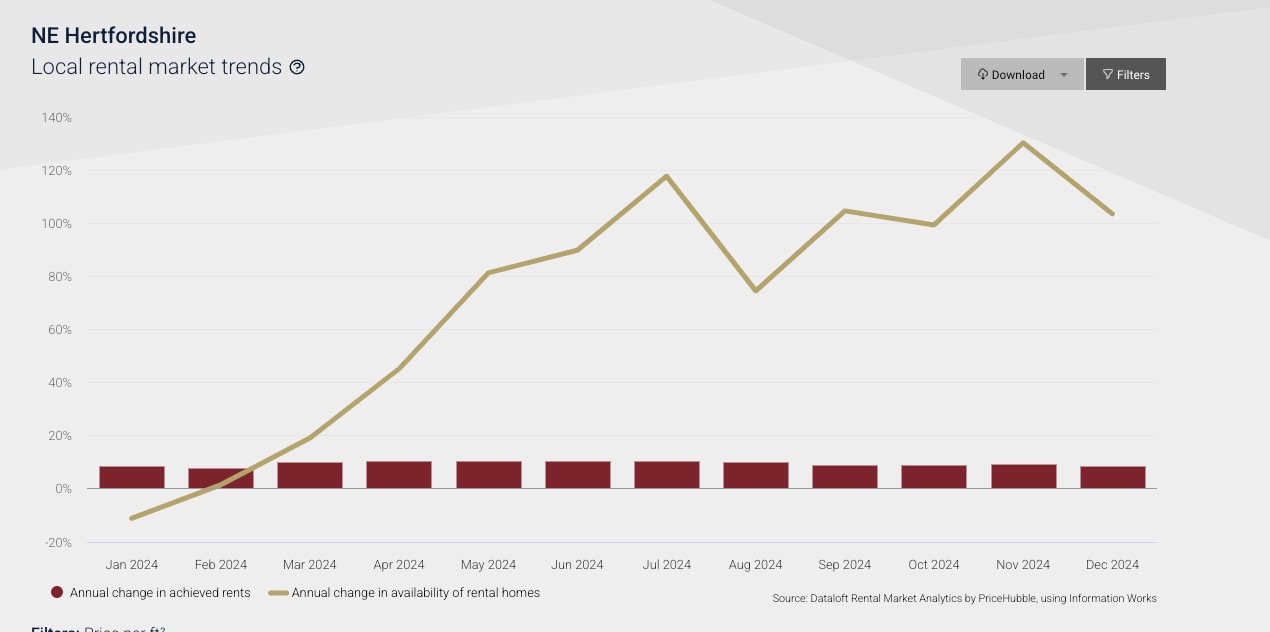

Local rental market trends

Year‐on‐year change rent levels remain positive, with consistent annual rent rises each month. Even with the availability of rental homes increasing locally, rents continue to rise—indicating that additional supply has not dampened tenant demand.

Overall, NE Hertfordshire’s rental sector remains buoyant. Even as more properties come to the market, yields are increasing, and rents are holding strong—particularly for family‐sized homes. With a sizable contingent of renters in the 30–39 bracket, demand shows few signs of slackening. For landlords, these figures reinforce the area’s strong fundamentals and underscore the continued desirability of properties across various price points.