Renters’ Rights Bill Nears Final Approval – What It Means for Landlords (Sept 2025 Update)

As part of our commitment to keep you informed, we’re sharing the latest on the Renters’ Rights Bill

After many months of debate, the Renters’ Rights Bill is in its final parliamentary stage, commonly known as “ping pong.” This is when the Bill moves between the House of Commons and House of Lords as they iron out last-minute differences on amendments. The Bill cleared the Lords in July, and on 8 September, the Commons considered the Lords’ changes. During that session, MPs rejected most of the Lords’ amendments, accepting only a few minor ones. The Bill now “pings” back to the Lords on 14 October for their response, after which it will likely return once more to the Commons for final approval a process that can continue until both Houses agree on the exact wording.

Importantly, final approval is imminent. The current expectation is that the Bill will receive Royal Assent by late October or November 2025, once the ping-pong process concludes. Royal Assent is when the Bill officially becomes the Renters’ Rights Act 2025. The House of Lords can delay matters slightly through ping-pong, but they cannot block the Bill indefinitely. Given the government’s commitment to these reforms, we expect the Renters’ Rights Act to be on the statute books before the end of autumn 2025.

When Will the New Rules Kick In? (Commencement Likely Mid-2026)

Even after Royal Assent this year, the changes won’t take effect immediately. The Act’s provisions will only start applying from a future “Commencement Date” set by the government. Based on current indications, the new tenancy system is expected to come into force in 2026, likely around Q2 (spring to early summer). In other words, we’re probably looking at May or June 2026 for the main tenancy reforms to actually begin.

Why the delay? The government has promised to give the rental sector “sufficient notice” and time to prepare for the new regime. There are also practical steps to complete first – drafting detailed regulations, updating court forms, issuing guidance, and setting up supporting measures like the new Private Renters’ Ombudsman and Property Portal. All of this work is underway, but it means the rollout must be done carefully. As Baroness Taylor (the housing minister in the Lords) explained, implementation must be handled “in a responsible manner,” allowing time to “get it right” with all necessary guidance and secondary legislation in place.

The upshot for landlords is that nothing major will change overnight in 2025. The transition will be managed, and you will have time to adjust. The Ministry (DLUHC) is planning a thorough communications campaign to raise awareness once timings are confirmed. Notably, the Act uses a “big bang” implementation, meaning on the chosen Commencement Date, all tenancies (existing and new) will suddenly fall under the new rules. There’s no phased introduction for existing contracts. So we can expect one clear switchover date in 2026 when the new system begins and the old rules (like Section 21 evictions) cease to apply.

Last-Minute Debates: Key Sticking Points in Parliament

While the core objectives of the Renters’ Rights Bill are agreed, a few specific sticking points are still being debated between the Lords and Commons as the Bill nears the finish line. Here are the main issues up for discussion in the ping-pong stage:

Selling-Up Ground (Ground 1A re-letting period):

The new Act will include a possession ground allowing landlords to regain a property if they intend to sell. However, there’s disagreement over how long the landlord must wait before re-letting if the sale doesn’t go through. The Lords voted to shorten this “no re-let” period from 12 months to 6 months for unsold properties, to give landlords more flexibility. The government opposes that change, insisting on a full 12-month ban on re-letting after using the selling-up ground, as a safeguard against abuse (to ensure the ground isn’t misused for an easy eviction and quick reletting at a higher rent) . This issue is still being thrashed out – landlords should be aware that if the 12-month rule stays, you truly must sell (or leave the property empty) for a year after evicting on this ground.

Student Tenancies (Ground 4A scope):

Another debated point is the special eviction ground for student landlords. In its current form, Ground 4A allows landlords renting to students to regain possession at the end of an academic year, but only for larger HMO properties (households of 3 or more students). The House of Lords proposed an amendment to extend this to all student lets, including smaller properties such as a flat shared by two students or any tenancy where the tenant is a full-time student. The government is opposing this expansion, arguing that some students (for example, postgraduates with families or others who have “put down roots”) might require more security and should not face routine turnover. In short, whether this end-of-tenancy ground applies to all student rentals or only to HMO-style student houses is still being decided.

Pet Deposits:

The Bill grants tenants the right to request a pet, and landlords must consider it (more on pets below). Currently, landlords cannot charge any extra deposit beyond the five-week cap set by the Tenant Fees Act 2019. The House of Lords proposed allowing an additional deposit of up to three weeks’ rent specifically to cover pet damage. Many landlords feel this would offer reassurance if they accept pets. However, the government disagrees and rejected the idea of a pet deposit. Ministers pointed out that an extra three weeks’ rent could be a large, unaffordable sum for tenants, and noted that data shows the average pet-related damage claim is around £300, which is usually covered by a normal deposit. For now, it appears no separate pet deposit will be permitted, though the government has left the door open to revisit deposit rules if evidence later shows a need.

Rental Bidding & Discrimination Penalties (Standard of Proof):

The Renters’ Rights Bill will ban practices like “rent bidding” (tenants offering above the advertised rent) and will penalise unlawful discrimination (e.g., blanket “No DSS” policies). A Lords amendment aimed to make enforcement of these rules more difficult by raising the standard of proof from civil to criminal level – in other words, requiring “beyond reasonable doubt” proof to impose penalties instead of the lower “balance of probabilities” threshold. The government strongly rejected that change. They argue that requiring criminal-level proof would make it “extremely challenging” for councils to enforce the rules, thus undermining the ban on rent bidding and discrimination. Therefore, it is expected that the civil standard of proof (balance of probabilities) will remain for these penalties, allowing local authorities to issue fines more easily when a landlord breaches the new advertising and tenant selection rules.

Other Minor Amendments:

A few other niche proposals were debated in the Lords, though these are less likely to be included. One was a new ground for eviction if the property is needed to house a carer for the landlord or the landlord’s family. The government is not keen to add this, noting there’s little evidence of such a need and warning that the suggested definition of “carer” was so broad it could be exploited. Another amendment would have allowed landlords who are leaseholders (shared owners) to re-let a property if a pending sale of their lease falls through, rather than waiting out the full no-let period. This too was opposed by the government, which felt it would weaken tenant protections in those rare cases. Lastly, the Lords attempted to extend the Decent Homes Standard to Service Family Accommodation (military housing), but that falls outside the scope of the private rental sector and was not accepted. These minor points may not appear in the final Act, but we mention them for completeness – they demonstrate how thorough the debate has been on all aspects of the Bill.

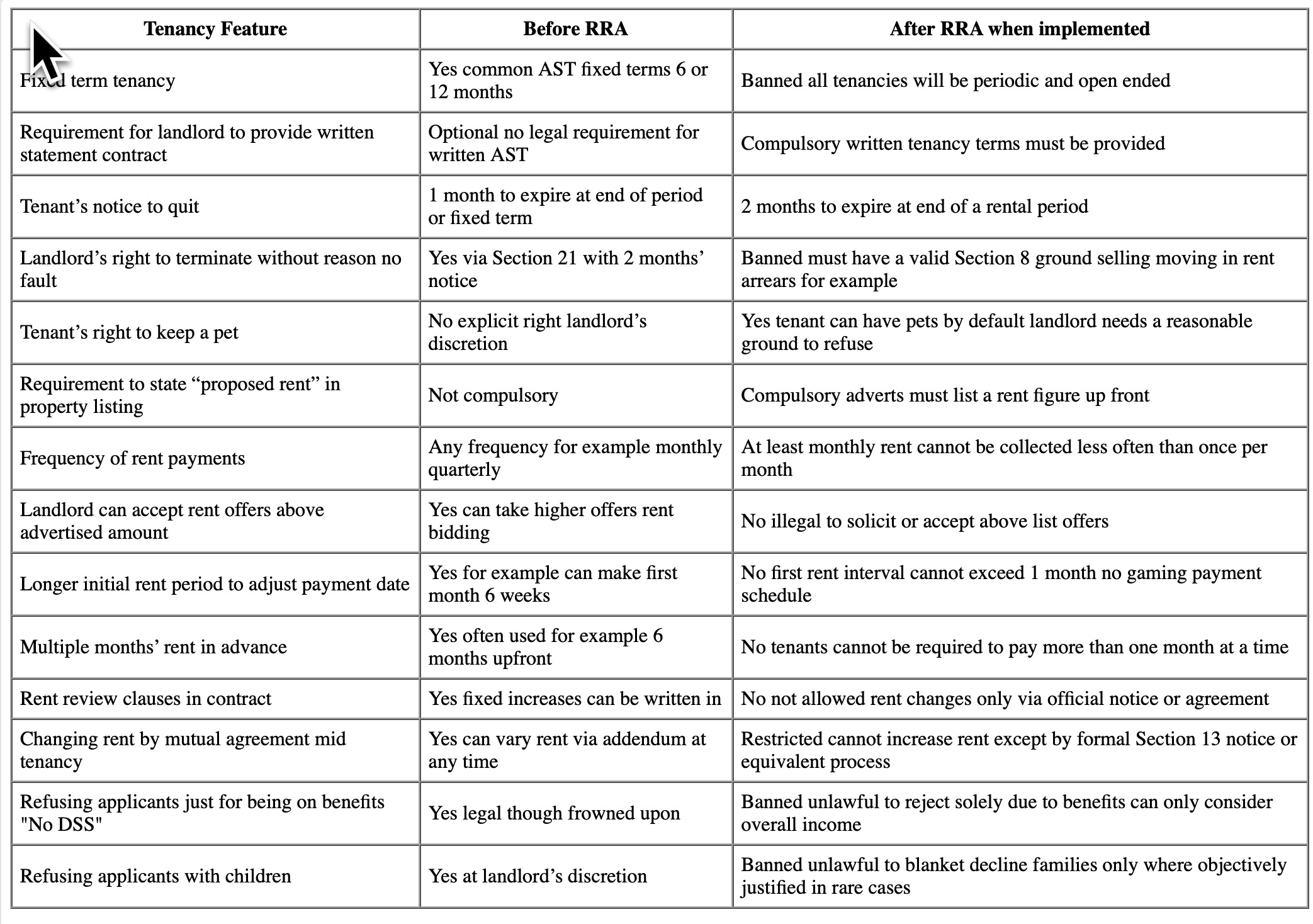

Key Changes for Landlords from Commencement Date (Mid-2026)

All existing ASTs become periodic:

On Day 1 of the new regime, every current Assured Shorthold Tenancy will automatically convert into a periodic tenancy. Fixed terms will effectively disappear – with no more end dates on tenancies rolling forward. Going forward, landlords won’t be granting fixed-term ASTs at all; instead, every new tenancy will be open-ended (periodic from the start).

Section 21 “no-fault” evictions abolished:

The ability to evict a tenant without providing a reason (by serving a Section 21 notice) will be completely abolished. Landlords will no longer be able to use the Section 21 route to regain possession. Instead, if eviction is necessary, they must follow the Section 8 process with a valid ground (such as wanting to sell, move in, or due to tenant rent arrears or breaches). In practice, this means you need a concrete reason to ask a tenant to leave, making proper documentation and compliance with tenancy terms more crucial than ever.

No fixed terms or rent review clauses:

Under the new law, you cannot specify a fixed-term period in a tenancy agreement – all contracts will be indefinite. You also won’t be able to include typical rent review clauses that specify rent increases after a set period. Any rent changes for periodic tenancies must follow the existing statutory process (serving a Section 13 rent increase notice, or by mutual agreement). In short, tenancies will be open-ended, and rent adjustments will be made through formal notices rather than automatic clause-driven uplifts.

Rent must be payable monthly (no large upfront sums):

The new regime will standardise how often rent is paid. Landlords cannot require rent less often than monthly. This will put an end to quarterly, biannual, or annual rent payments, unless a tenant voluntarily chooses to pay in advance. Notably, you also cannot manipulate an extended initial rent period to alter payment dates (for example, making the first “month” six weeks long to collect more upfront). The law guarantees a regular monthly cycle, which should help tenants budget and prevent very large upfront demands. Essentially, you will be collecting rent monthly in almost all cases.

Tenants free to have pets (by default):

Perhaps one of the most talked-about changes is that tenants will gain an explicit legal right to keep a pet in the property, as long as they notify the landlord. As a landlord, you will only be able to refuse permission if you have a valid reason in writing – for example, the property isn’t suitable for animals, or perhaps due to a severe allergy in a shared building. You cannot charge extra pet rent or fees, and as noted, no additional pet deposit is currently permitted either. This means allowing pets may carry a bit more risk for landlords, but you can still require tenants to cover any damages. The key is that a blanket “no pets” policy will no longer be enforceable; each request will be considered on its merits.

Must provide written tenancy terms:

Under the new Act, all landlords will be legally required to provide a written tenancy agreement (or written statement of terms) to tenants. Currently, having a written AST is good practice but not mandatory, and some periodic tenancies may be oral. Moving forward, written terms will become compulsory – which is sensible for clarity and will likely be enforced through the new Ombudsman or penalties if not provided. In short, paperwork cannot be omitted; you should have solid written contracts prepared for all tenancies (something your letting agent can help with).

No rent bidding or above-market offers:

The Renters’ Rights Act will ban “rental bidding.” When advertising a property, you’ll have to state a fixed asking rent, and you cannot encourage or accept offers above that advertised rent. This means no more informal bidding wars where tenants compete to pay more. Landlords will need to stick to the listed price. This change aims to make renting fairer and more transparent for tenants. It’s important to note that local councils will enforce this, and accepting a higher offer (even if a tenant volunteers it) could result in a fine. The best approach is to set a realistic market rent and stick to it.

No blanket bans on benefit tenants or families:

Discrimination in tenant selection will be explicitly prohibited. You cannot refuse an applicant solely because they receive housing benefit or Universal Credit, nor can you categorically reject renting to families with children. Of course, you can still carry out normal affordability and reference checks and you’re permitted to consider income and suitability but you must assess each applicant individually.

Looking Ahead:

These reforms are extensive, but landlords can certainly adapt and succeed under the new regulations. The key is to stay informed and begin planning early. There may be challenges, for example, adjusting to life without no-fault evictions or being unable to insist on large upfront rent payments, but with good preparation, you can manage the risks. In fact, many changes, like improved documentation and clearer standards, can benefit conscientious landlords who already follow good practices.

Remember, you’re not alone in this. Lean on trusted letting agents and professional property managers for guidance. A knowledgeable letting agent (like our team here at Putterills) will help ensure you remain compliant with the new law from day one. We can assist with updating tenancy agreements, advising on the new grounds for possession, handling pet requests reasonably, and navigating rent increase procedures correctly. With expert support, you’ll be well-equipped to handle things like the transition of fixed terms to periodic or the end of Section 21 smoothly and with confidence.

In summary: The Renters’ Rights Bill is almost law, and big changes are on the horizon for mid-2026. We hope this update gives you a clear, practical overview of what to expect. Rest assured, with the right knowledge and support, you can successfully navigate the changes. As always, Putterills is here to help our landlords through this transition, ensuring your rental investments remain well-managed, compliant, and profitable in the new era of renting. Here’s to moving forward together with confidence!